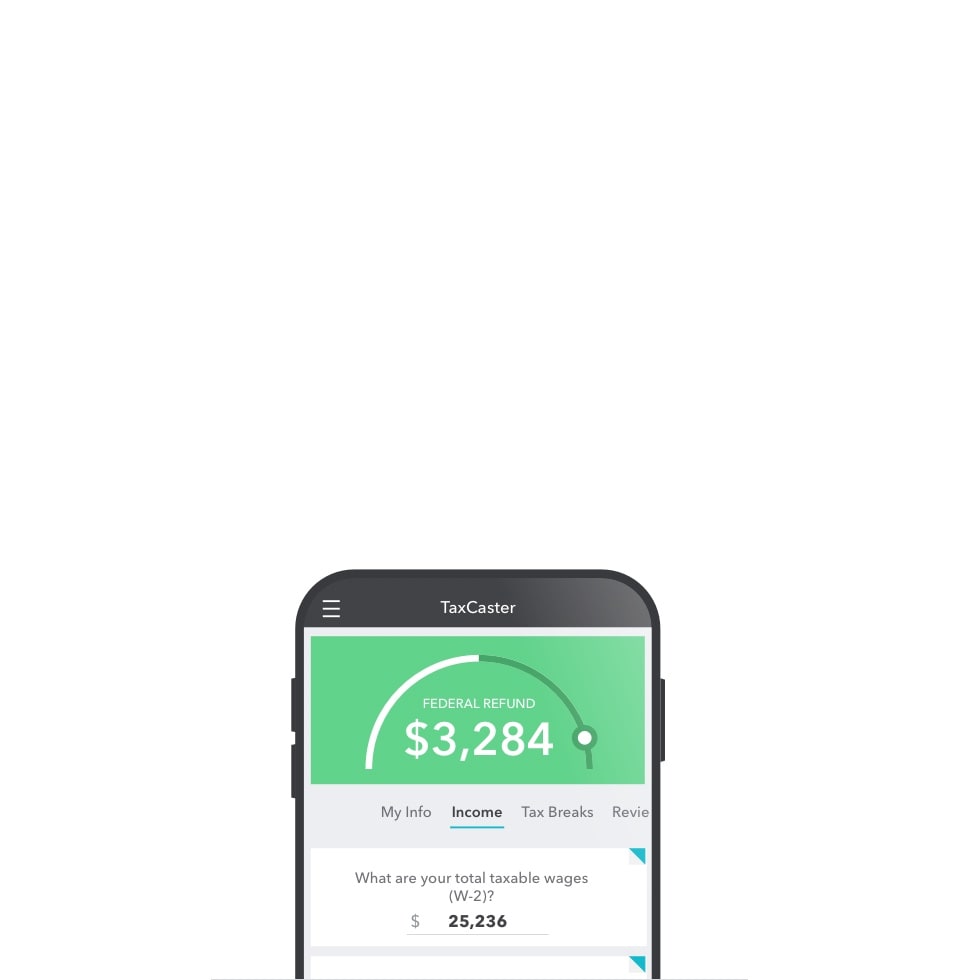

The IRS will start processing tax returns on Monday, January 23, 2023.Don't wait to file. The remaining amount of your federal refund (which is your original federal amount minus the Refund Advance and any other elected TurboTax service fees) and/or state refund, if applicable, will be deposited into your checking account with Credit Karma Money when the IRS or state tax authorities (if applicable) distribute your refund. Pay for TurboTax out of your federal refund. There are 8 free software versions available from the IRS Free File site. **Free withdrawals available at ATMs in the Allpoint network. Get When Will Turbotax Pay With Refund Be Available 2022 MP3 Complimentary in Top Song uploaded by TurboTax. The Refund Processing Service option only appears if you have a, Refund Processing Service can only be used, Fees, if any, are charged once, when the IRS processes your return. Taxpayers approved for the tax refund advance program can access funds as quickly as 12 hours after the IRS accepts their return. Last tax season close to 70% percent of taxpayers received a tax refund, and the average federal tax refund was close to $3,000.

* However, there are fees for using your Credit Karma Visa Debit Card at out-of-network ATMs. If you dont qualify after filing your return, you'll still receive your refund in your checking account with Credit Karma Money. Recovery rebate credit It is better to pay for the software upfront using a credit card than to face the extra $39.99 fee and the possibility of the fees coming out of your account at a very inconvenient time.

Well help you create your account for funds to be deposited into after the IRS The fees can only be deducted from your federal tax return. TurboTax for Tax Year 2021 is Now Available, The Pros and Cons and Tax Implications of Owning Income Property, How To Manage a Side Hustle While Keeping Your Day Job, Including the Finances, Simple returns, including employment income, RRSPs, dependents, student credits and COVID-19 benefits, Maximizing credits and deductions with slightly more complex tax situations, such as medical expenses and donations, Investors with income from stocks, bonds, cryptocurrency, rental property, capital gains and losses, and foreign income.

In fact, 70% of our customers receive funds within 1 minute of IRS e-file acceptance1.

0 kommentar(er)

0 kommentar(er)